Why use TurboTax in 2023?

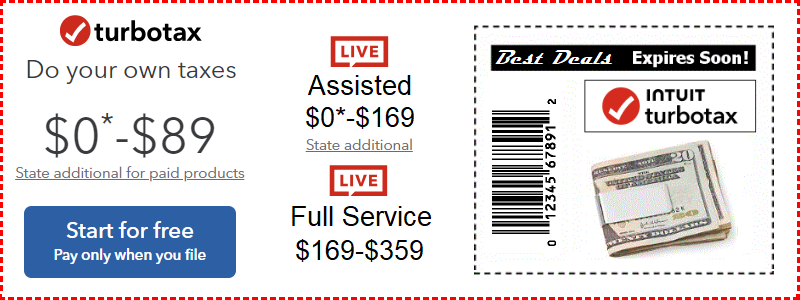

As a TurboTax Affiliate, we are glad to offer TurboTax Tax Software for your 04/15 tax filing. You can purchase your TurboTax software here through our website to prepare your tax return to be filed by the tax filing deadline of April15th 2022.

Choosing the right edition for your tax filing needs will insure your

getting all the guidance you need to get your biggest refund. TurboTax 2023

offers a tax preparation product for every tax filer. Their software editions

are designed to find every deduction possible and include:

TurboTax Online 2023 Tax Filing

- Turbo Tax Freedom Edition

- Turbo Tax Free Edition for simple tax returns only "not all taxpayers qualify"

- Turbo Tax Deluxe Edition

- Turbo Tax Premier Edition

- Home & Business Edition

TurboTax will be updated to help you with all the Upcoming Tax Changes for your 2023 tax filing, which include:

Upcoming tax law changes...

- The standard deduction amount will nearly double in 2018 to $12,000 for individuals filing their tax return in April 2023. Married couples will qualify for a standard deduction of $24,000, up from $13,000 for 2023 taxes. Plus, head of household tax filers will see an increase in their standard deduction from $9,550 to $18,000.

- Personal exemptions. There's a catch to the new standard deduction you need to know about. "Taxpayers lose their $4,050 personal and dependency exemptions," However, the increase in the child tax credit can offset the personal exemptions loss, but not for everyone.

- Mortgage interest deduction. A restriction on the amount of mortgage interest that can be deducted for 2018, when filing your return in 2023 allows only interest on a mortgage value capped at $750,000 to be deducted.

- Unlimited state and local tax deductions. State and local taxes will be capped at $10,000 when filing your taxes in 2023. "That's huge for the people in South Florida," Farra says. It will also have a significant impact on those in New York, California and other states where people pay high property taxes.

- Deduction for home equity loan interest. A change to interest

deductions for

home

equity loans means the home equity line of credit interest [deduction]

is gone. Those who have an existing home equity loan can't deduct the

interest after 2017 unless it is connected to home improvement." Plus,

combined first mortgage and home equity loan can't exceed $750,000.

home

equity loans means the home equity line of credit interest [deduction]

is gone. Those who have an existing home equity loan can't deduct the

interest after 2017 unless it is connected to home improvement." Plus,

combined first mortgage and home equity loan can't exceed $750,000. - Un-reimbursed employee expenses deduction. Un-reimbursed purchases related to your job that exceed 2 percent of your adjusted gross income is being eliminated.

- Un-reimbursed work expenses These deductions have been disallowed under the new law, along with un-reimbursed qualified employee education expense deductions.

- Moving expense deduction. This deduction is eliminated for everyone except armed forces members.

- Unrestricted deductions for natural disasters. When filing your tax return in April of 2023, not everyone will have access to this deduction. You must be in a presidential designated disaster zone to take advantage of this deduction from here on.

- Alimony deduction. This won't be an option in 2023. The deduction is being eliminated for any divorce commencing after Dec. 31, 2018.

TurboTax 2023 Desktop Software Downinclude/CD Installation Editions

Intuit consistently stays within the top 100 companies to work for. Should you ever have the chance I'd suggest you read "Inside Intuit."

Its an incredibly unique company right from its very roots and it hasn't lost that small business feel.

InsideIntuit covers a modern-day David and Goliath story of a company

dreamed up at a kitchen table, built on explosive PC growth, and forced

to battle a giant in the race to revolutionize an industry. It's the story

of the Intuit corporation, creator of renowned software products like Quicken,

QuickBooks, TurboTax, Mint, Website Creator and many more top performing

software products. This company beat the mighty Microsoft and changed the

way 25 million people manage their finances.

All intuit employees are encouraged to work independently within their jobs.

They are encouraged to always step outside the box, take career risks (in

a good way), come up with personal designs and programs that can be implemented

within the company. Creativity is rewarded. So, consequently the intelligence

level there is really high.

There is little doubt that all this employee talent will be reflected in the TurboTax 2023 tax software editions for the upcoming tax season.

Over the years TurboTax has dominated the online tax filing industry by a very large margin. This year the Turbo Tax 2023 tax filing versions, (both Online and Download / CD) services will allow consumers to calculate their tax return refund in advance, as well as prepare and file there return online to receive their tax refund by direct deposit fast.

Popular Features in TurboTax 2023 Products Include:

- Prepare your return yourself and avoid paying exorbitant professional tax preparation fees

- It's easy to use and guides you through the tax prep process like a GPS

- Prepare and file your taxes from the comfort of your own home at anytime, day or night.

- An audit warning notification system points out entries that could trigger an audit.

- It's the most comprehensive tax preparation software with guaranteed accurate calculations

- Work online or, download and install desktop software. Whichever work best for you.

- Free Updates keep you in tune with the latest tax law changes as they happen.

Compare TurboTax 2023 Tax Software Editions

The Turbo Tax 2023 Editions are PC and Mac Compatible, so regardless of what operating system your pushing, you can get your tax filing job done with ease. Plus, preparing and filing directly from your computer will cost you far less than hiring a tax professional or high priced CPA.

If you were still preparing your taxes with pen and paper last year, you may be surprised to learn that an estimated 100 million tax returns will be filed online electronically during the 2023 tax season. This trend show the growing popularity of online tax filing for accurate and fast income tax returns.

If you are expecting a refund check, filing by efile is a great choice along with direct deposit into your bank account.

The IRS can process your return and issue a tax refund much quicker than if you mailed a paper return in.

By using your computer, forms are digital and much more legible than hand-written returns, which can reduce potential errors.

Join the tens of millions of people who have discovered how easy TurboTax 2023 can be to use. The cost of preparing your return will be lower, your tax forms will get to the IRS without hand-written errors, and you can receive your tax refund faster than ever.

By preparing and filing your tax return with any of the TurboTax Versions or Edition, you can avoid doing everything by hand, save the cost of a paid tax professional, and get your tax refund quicker than ever so there is not long waiting period for money the IRS owes you!